Membership Overview

Creating safer drivers by empowering driver trainers

ADTA Membership and

Professional Indemnity / Public Liability Pricing

Please note:

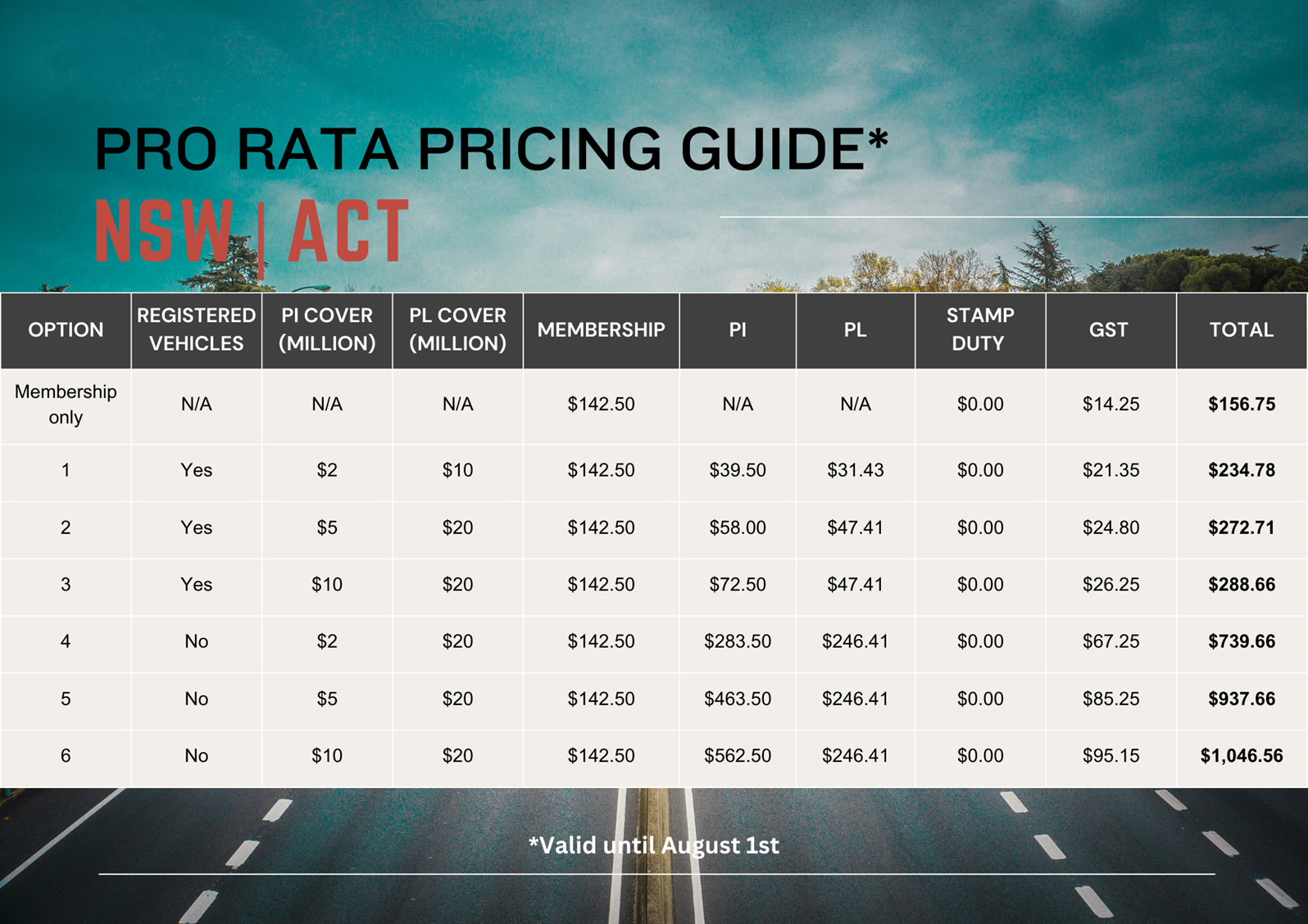

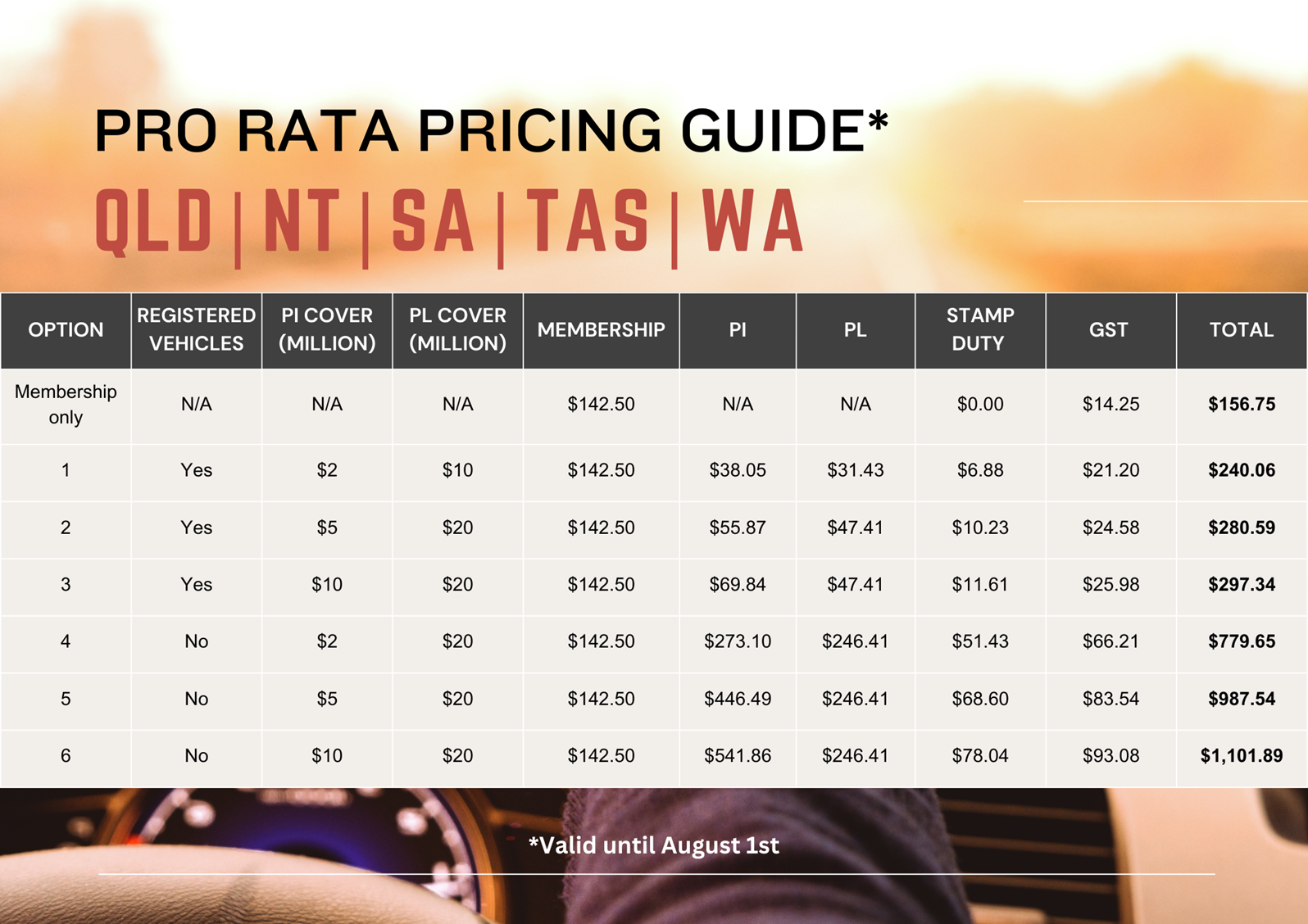

Our current pricing reflects pro rata half year membership rates. All memberships, regardless of join date, will expire on August 1st each year. We offer a pro rata rate only once annually, commencing February 1st.